Something’s brewing in India’s tax world, and it’s got millions of people scrambling. We’re just two weeks away from a crucial deadline that could hit your wallet hard if you miss it.

The ITR filing deadline AY 2025-26 has become the talk of every office water cooler and WhatsApp family group. But here’s the thing – this isn’t your regular yearly tax story. There’s more to it behind the scenes than most people realize.

The Deadline That’s Already Been Pushed Once

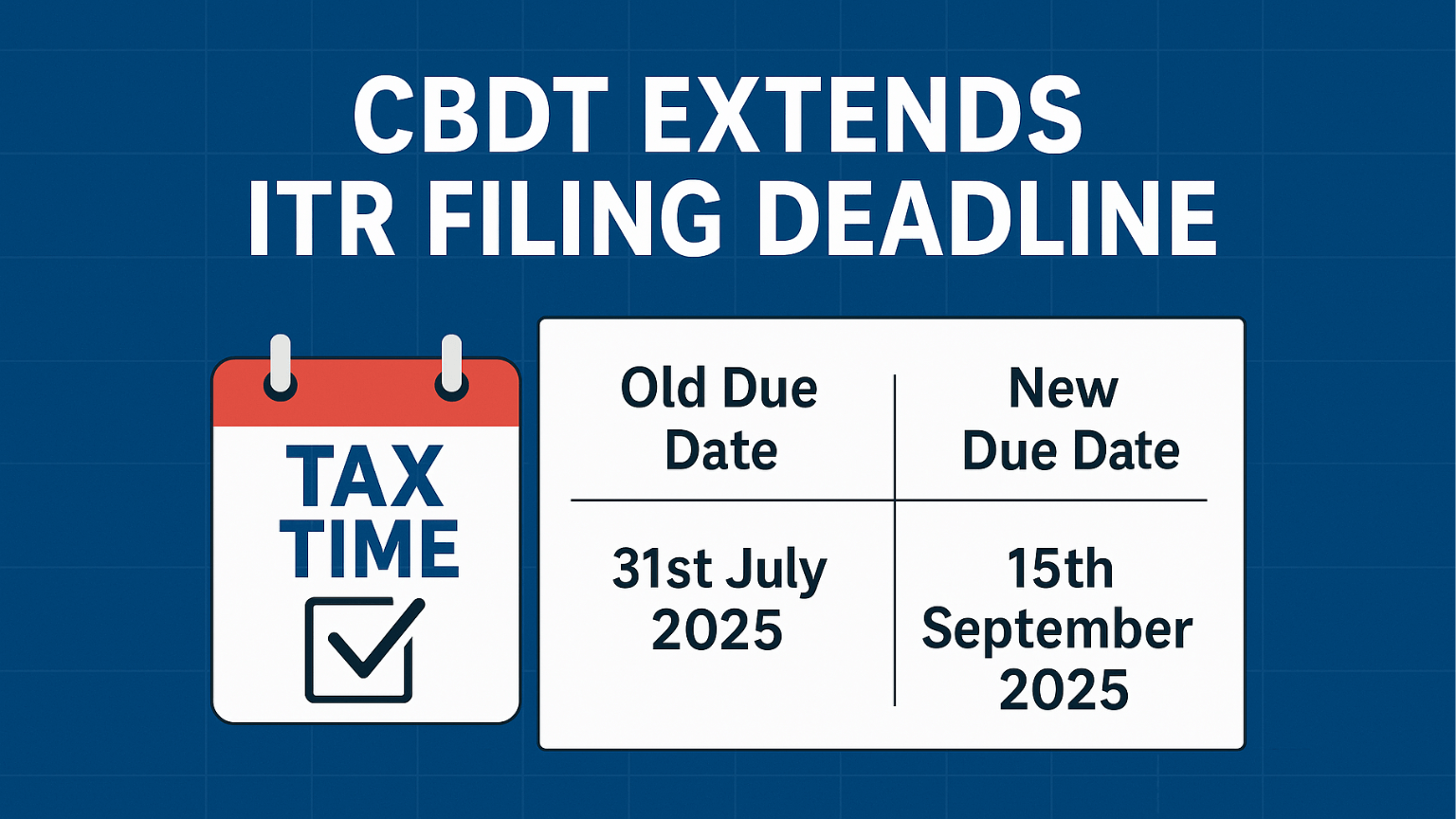

Remember when you used to panic about July 31st? The government already gave everyone a breather by moving the ITR filing deadline AY 2025-26 to September 15, 2025.

Why? Because this year’s tax forms got a major makeover. The Central Board of Direct Taxes (CBDT) extended the deadline because the ITR forms underwent significant structural and content changes aimed at making compliance simpler and more transparent. But apparently, “simpler” needed more time to actually become simple.

“The forms have been completely revamped,” said one tax consultant we spoke with. “It’s like learning to drive a new car when you’re already running late for work.”

Here’s What Happens If You Miss It

Missed September 15th. Late filers face a penalty of Rs 5,000, though it drops to Rs 1,000 if your annual income is below Rs 5 lakh.

But wait, there’s more. If you owe taxes, you’ll also pay 1% interest every month on whatever you haven’t paid yet. That adds up faster than you’d think.

The good news? You can still file something called a “belated return” until December 31st. It’s like showing up to a party after it’s officially over – you can still get in, but you’ll pay extra for being late.

Why Everyone’s Asking for More Time

Here’s where it gets interesting. Even with the extended ITR filing deadline AY 2025-26, people are still asking for more time. Professional tax bodies, business chambers, and even individual CAs are basically saying, “Hey, we need longer!”

As of late August, only 3.90 crore ITRs had been filed compared to last year’s total of 9.1 crore. The Chandigarh Chartered Taxation Association and Gujarat Chamber of Commerce aren’t mincing words. They’re pointing fingers at portal glitches, TDS mismatches, and forms that are apparently harder to fill than expected.

The Technical Error Behind the Scenes

Want to know what’s really causing the problem? It’s not just about people being lazy with their paperwork.

The government’s tax portal has been acting up. Imagine trying to submit an important tax returns online, but the website keeps crashing or showing wrong information. That’s exactly what’s happening with Form 26AS and something called AIS (Annual Information Statement) not matching up properly.

Plus, companies were supposed to submit TDS details by May 31st, but those numbers only started showing up in people’s accounts by early June. So taxpayers had less time than usual to cross-check everything before the original July deadline.

What the Numbers Really Tell Us

Let’s break this down in simple terms. Over 2.93 crore returns have been filed since the process began in May, but experts expect around 9 crore total returns this year based on last year’s numbers.

That means about 6 crore people still need to file their ITR filing deadline AY 2025-26 returns in the next two weeks. It’s like having 60% of your class still working on an assignment that’s due tomorrow.

The Government’s Dilemma

Here’s what the authorities are thinking: give another extension and ignore off the entire tax schedule, or stick to September 15th and handle whatever problems come up.

“The government is walking a tightrope,” explains a senior tax professional. “They don’t want to keep pushing dates because it affects advance tax payments, GST filings, and audit submissions down the line.”

Tax authorities are monitoring both filing volumes and the technical performance of the portal to decide whether another extension is needed.

What Changed This Year Anyway?

The ITR filing deadline AY 2025-26 forms aren’t just surface-level different – they’ve been rebuilt from scratch. New rules about capital gains reporting, different sections for various types of income, and updated deduction claims.

One major change: if you’re born after April 1, 2007, you can’t use the simplest form (ITR-1) anymore. That’s caught some young taxpayers off guard.

The Smart Move Right Now

Don’t wait. With only two weeks left until the ITR filing deadline AY 2025-26, portal traffic is about to get overwhelming.

Filing early means:

- You avoid the last-minute rush

- Portal crashes won’t affect you

- You have time to fix mistakes if needed

- Your refund gets processed faster

If you make an error in up your return after filing, you can still correct it through a “revised return” until December 31st. But it’s better to get it right the first time.

The Bottom Line

The ITR filing deadline AY 2025-26 situation shows how complex tax filing has become in India. While the government wants to make things easier with new forms, the transition period is causing more problems than anyone expected.

Whether we get another extension depends on how many people file in the coming days and whether the portal can handle the load. For now, the smartest move is to file before September 15th and avoid the whole situation altogether.

Remember, the ITR filing deadline AY 2025-26 affects millions of Indians, and the government’s decision in the next few days could determine whether this becomes a smooth process or a chaotic scramble to meet deadlines.